Current bond price formula

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Cash Flow from Operations Formula.

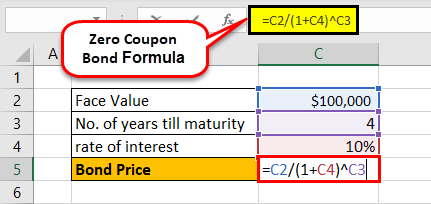

Zero Coupon Bond Formula And Calculator Excel Template

Bond price when yield increases by 1 Price-1.

. The forward price is concerned with the physical delivery of an underlying financial asset commodity Commodity A commodity refers to a good convertible into another product or service of more value through. Bond valuation is a technique for determining the theoretical fair value of a particular bond. It gives an idea to the investor whether a company has the ability to generate enough cash to pay back its short-term liabilities.

The formula for a current account can be derived by using the following steps. Subtotal 3000 30. Every sweet feature you might think of is already included in the price so there will be no unpleasant surprises at the checkout.

Relevance and Use of Current Yield of Bond Formula. This lets us find the most appropriate writer for any type of assignment. With our money back guarantee our customers have the right to request and.

Next figure out the current market price of the bond. It returns a clean price and dirty price market price. Well always be happy to help you out.

CBS News Bay Area. Therefore each bond will be priced at 83879 and said to be traded at a discount bond price lower than par value because the coupon rate Coupon Rate The coupon rate is the ROI rate of interest paid on the bonds face value by the bonds issuers. In finance bond convexity is a measure of the non-linear relationship of bond prices to changes in interest rates the second derivative of the price of the bond with respect to interest rates duration is the first derivative.

Percentage point change in yield note that its squared. Yields are highly dependent on interest rates. Earnings Per Share Formula.

60 e 006 0417 60 1025336 6152 Therefore the FP is 6152. Current Yield of Discount Par Premium Bonds. Annual coupon payment Current market price 100 950 1053 Scenario 2.

Current Yield Coupon Payment in Next One Year Current Market Price 100. Bond price is calculated as the present value of the cash flow generated by the bond namely the coupon payment throughout the life of the bond and the principal payment or the balloon payment at the end of the bonds lifeYou can see how it changes over time in the bond price chart in our calculator. Premium bond Premium Bond A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value.

Sign doesnt matter But stick with the better convexity formula if you have time to calculate it or come back and visit this page. Explanation of Current Ratio Formula. Bond convexity is one of the most basic and widely.

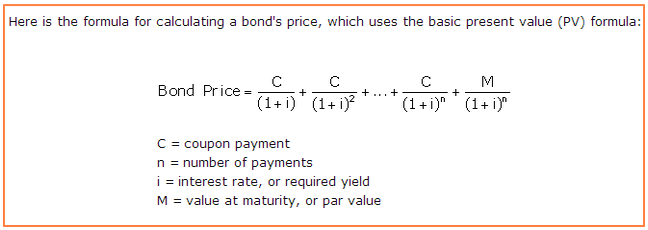

Finally the formula for a current yield of the bond can be derived by dividing the expected annual coupon payment step 1 by its current market price step 2 and expressed in percentage as shown below. This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market sometimes known as a yield to price calculator. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows which include coupon payments and the par value which is the redemption amount at maturity.

The PV is calculated by discounting the cash flow using yield to maturity YTM. Bond price when yield decreases by 1 Price. Get the latest financial news headlines and analysis from CBS MoneyWatch.

Simple Interest Rate Formula. The difference between the current yield and coupon rate of a bond stems from the pricing of the bond diverging from. YTM interest rate or required yield P Par Value of the bond Examples of Bond Pricing Formula With Excel Template Lets take an example to understand the calculation of Bond Pricing in a better manner.

This occurs when a bonds coupon rate surpasses its prevailing market rate of interest. Current Yield of Bond Formula. To use bond price equation you need to input the following.

Firstly determine the export of the nation which is the value of the goods and services produced within the nation and sold outside the nation and it is denoted by X. Current Yield 80 Annual Coupon 970 Bond Price. Shipping cost delivery date and order total including tax shown at checkout.

It determines the repayment amount made by GIS guaranteed income security. Mathematically the formula for coupon bond is represented as. The forward price must not be confused with future prices.

The current ratio measures liquidityworking capital management of the company. You can contact us any time of day and night with any questions. Current Yield 825.

Current trading price Δyield. The term bond formula refers to the bond price determination technique that involves computation of present value PV of all probable future cash flows such as coupon payments and par or face value at maturity. N Period which takes values from 0 to the nth period till the cash flows ending period C n Coupon payment in the nth period.

Local News Weather. 00 x 30. For instance if a corporate bond.

Formula to Calculate Bond Price. In general the higher the duration the more sensitive the bond price is to the change in interest rates. Finally the formula for current yield can be derived by dividing the bonds coupon payment expected in the next one year step 1 by its current market price step 2 as shown below.

Here we discuss how to calculate Mode Formula along with practical examples Calculator and excel template. The higher the ratio the more current assets a company has compared to its liabilities. Read more is basically.

Bond valuation includes calculating the present value of the bonds future interest payments also. Current Yield Annual Coupon Bond Price. You calculate current yield by dividing the annual interest earnings by the current market price of the bond 5 110 in this case.

It sums the present value of the bonds future cash flows to provide price. Find in-depth news and hands-on reviews of the latest video games video consoles and accessories. CBS News Live CBS News Bay Area.

Current Yield Annual Coupon Payment Current Market Price of Bond 100. The yield to maturity YTM refers to the rate of interest used to discount future cash flows.

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Pricing Formula How To Calculate Bond Price Examples

How To Calculate The Current Price Of A Bond Youtube

Quick Guide On Bond Prices And Formula Bond Calculator Pricing Market Consensus

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Yield Calculator

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Bond Yield Formula Calculator Example With Excel Template

Bond Pricing Formula How To Calculate Bond Price Examples

How To Calculate Bond Price In Excel

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Excel Formula Bond Valuation Example Exceljet

An Introduction To Bonds Bond Valuation Bond Pricing

Yield To Call Ytc Bond Formula And Calculator Excel Template

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

How To Calculate Bond Price In Excel